Planning for retirement can feel daunting, though it's crucial to start early and maximize your savings potential. A top-rated 401(k) plan offers an exceptional opportunity to accumulate wealth over time. These plans provide valuable benefits, such as tax advantages and employer matching contributions, which can significantly increase your retirement nest egg. By choosing a well-structured 401(k) plan with a diverse range of investment options, you can adjust your portfolio to align with your risk tolerance and financial goals.

- Consider the plan's fees and expenses.

- Review the investment choices available.

- Consult a financial advisor for personalized guidance.

Unlocking the Potential of Your 401(k): A Guide to Success

Your 401(k) is a essential tool for building your financial future. To truly harness its potential, it's crucial to know how it works and implement a effective plan. This guide will provide you the knowledge you need to master the world of 401(k) investing and set yourself up for long-term success.

- Begin by exploring your alternatives.

- Deposit regularly to benefit your savings.

- Diversify your portfolio to mitigate risk.

Consider professional advice from a investment advisor for personalized guidance. By implementing these strategies, you can unlock the full potential of your 401(k) and realize your retirement goals.

Best 401(k) Plans for Every Investor

Navigating the world of retirement savings can be daunting, especially when confronted with a plethora of alternatives. A 401(k) is often considered a cornerstone of any robust retirement strategy, offering tax benefits and potential for earnings. However, with so many companies vying for your attention, selecting the optimal plan can feel overwhelming. Therefore we've compiled a comprehensive guide to help you discover the best 401(k) plans that align with your unique investment goals.

To commence, it's crucial to assess your risk appetite. Do you prefer a conservative investment strategy? Once you have a grasp of your risk profile, you can narrow down plans that offer aligned fund allocation options.

Moreover, it's wise to review the costs associated with each plan. High fees can substantially erode your earnings.

Navigating 401(k) Options: Choosing the Right Plan for You

When it comes to your long-term savings, a 401(k) can be a powerful tool. Nevertheless, with so many numerous plans available, choosing the right one can feel challenging. First, it's crucial to comprehend your individual retirement aspirations. Consider your risk tolerance and how much you're willing to invest each month.

Once you have a clear concept of your desires, you can commence exploring different 401(k) plans. Consider factors like the matching contribution offered, the portfolio choices, and any charges. Don't be afraid to seek clarification to your human resources department for assistance.

Navigating The Top Best 401(k) Plans in 2023

Planning for retirement can feel overwhelming, but choosing the right 401(k) plan doesn't have to be. In 2023, a plethora of plans are available, each with its own pros. To help you select the perfect fit for your needs, we've created a list of top picks based on factors like investment selection, costs, and overall return. Whether you're aiming to achieve low annual costs or diverse asset allocation, this guide will provide you with the information you need to make an informed decision.

- Analyze different plan providers and compare their offerings carefully.

- Evaluate your risk tolerance and investment goals when picking funds.

- Leverage any employer matching contributions available.

- Monitor your portfolio performance regularly and make adjustments as needed.

Boost Your Retirement Nest Egg: Exploring Top-Performing 401(k)s

Securing a comfortable retirement requires careful planning and read more smart financial decisions. A well-structured retirement plan can be a cornerstone of your retirement strategy, allowing your funds to grow over time. With so many plans available, it's crucial to choose a 401(k) that aligns with your financial goals and risk tolerance.

To help you navigate the complex world of retirement savings, we've compiled a list of top-performing 401(k) companies. These institutions offer a range of features and benefits, including competitive investment options, low fees, and robust customer support.

- Evaluate the average return of different 401(k) accounts.

- Review the expenses associated with each provider.

- Allocate your investments across different sectors to manage risk.

By carefully considering these factors, you can select a top-performing 401(k) that sets you on the path to a financially secure retirement.

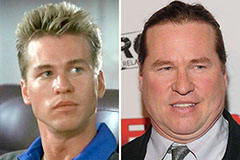

Val Kilmer Then & Now!

Val Kilmer Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Kane Then & Now!

Kane Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!